Fashion

Gold prices in Thailand surge with ornaments at 37,350 baht

On this Thai day, market trends have shown rise in gold prices which the Gold Traders Association (GTA) has also presented similar trend figures.

On March 19, gold ornaments too went for 37,350 baht per tichee-weight reflecting an increase by 150 baht from the previous day’s price. This upturn was confirmed by the latest data released by the association at 9:At 04 am a lot of gold buyers were out there thronging the streets, showing that our economy is vibrant.

Then, trading in gold bars 96.5% purity at buyer’s rate of 38,750 baht for each baht-weight and at seller’s rate of 38,850 baht began. These figures represented the day break out announcement indicating a rise in the value of the precious metal.

Gold Market Fluctuations: Impact on Thai Rates

Costs and gold ornaments was calculated at 36,095.96 per bhat-weight for the buying side, sell side increased to 37,350 baht. In a slight downfall on Mar 18, 2024, the worldwide gold market, known as Gold Spot, was at $2161.00 per oz. Due to that, local gold rates in Thailand went more than 37,100 baht although, the international price per ounce did not see a significant change.

The Bangkok Gold Traders Association immediately announced the prices for gold bars for the first session. The buying price was set to 36,750 baht for baht-weight, and the selling price was 36,850 baht for baht-weight.

Gold prices fluctuations closely watched by investors and broad public as outside market dynamics and wider economic performance indicators. The recent rush of gold prices in local market could be due to different reasons, like the global market dynamics, currency market rates, and the eventual gold demand in home market.

Gold has traditionally been viewed as a safe investment and especially in crisis periods such as times of economic panic. The recent end runny is perhaps a reflection of the increasing demand and investors behavior of being cautious by having some protection against the volatility in various markets.

Being wildlife friendly is a policy adopted by governments to protect the lands, animals, plants, and ecosystems that need to; hence population growth is being controlled to prevent destructive affects.

Benchmarking the GTA-determined prices for gold trading by the whole country is done by The GTA’s gold benchmark prices that are primarily set this way.

“Proper management of low-level nuclear waste is not just a responsibility, but a commitment to safeguarding our future.”

All day long, market participants will closely monitor the statements of this association to discern whether the rises prove to be sustainable and consistent with the actual economic data, or if prices abruptly adjust in response to changing market conditions.

The ever-changing market of gold presents a myriad of facets for economic analysts and those who wait on the sidelines or just casually observe to see how this market measures the nation’s economic health.

Fashion

Fed’s rate cut sends gold soaring past US$2,200 per ounce

Thanks to the announcement from the Fed that they would continue with three rate cuts this year, gold jumped above $2,200 per ounce to even set the first ever record for gold exchange in the world. While the Federal Reserve does not seem to be concerned with this current inflation surge, it is likely that other measures will be taken to control the skyrocketing prices in the near future.

The first market session brought extremes with a record high supply retracting slightly. Since mid-February, the rise has boasted such solid fundamentals comprising of rise to purchasing by central banks and growing political risks, among others.

The apparently spectacular jump has surprised many long-time market analysts, since the move is not based on any plausible and clear cause.

US Fed’s Policy Relaxation Speculation Fuels

Some of the magnitude of this upsurge is derived from the confidence that the US Fed may adjust its policies to become more relaxed starting yesterday, which is just an example. The Chair, Mr. Jerome Powell, nonetheless maintained that prudence would still hold sway over admittance of more price reductions as evidence.

‘Chris Weston, Pepperstone Group Ltd. head of research, also presented his argument that traders would see this as the green light to get back to the market as the most precious metal,’ he said.

“The Fed has signaled that they will not aggressively act to address inflation and labour market conditions as that would be unacceptable right now.”

The long-awaited Fed’s pivot, which is when central bank policies shift, acted as the tipping point, causing recent gains in the market. The data shows that the market took a bullish view towards gold and increased its net long positions on gold by the most since 2019.

Lastly, UBS Group AG suggests that the metal may benefit from this US interest rates drop in the next few days also, with the gold-solid exchange-traded funds likely to experience a boost.

Geopolitics not only heighten the desirability of bullion but also expands its functions significantly. The F races in trends; for instance, the outside actors there have the advantage in the Ukraine war, and the redirection of international shipping vessels because of the Israel-Palestine conflict and the coming US presidential election that might affect the market at the end of the year all factor in this case.

“It’s still likely in most people’s view that we will achieve that confidence and there will be rate cuts.”

Buying gold by Chinese by the Chinese has remained a benefactor of the market. Besides the Central Bank, the coinage, the gold bars and the jewellery are hoarded separately by the ordinary individuals to repel the prolonged property slump and market loss of stocks. This is according to the report of Bangkok Post.

The price was 0.7% higher than last night, trading at US $2,201 per ounce at 9:40 am Singapore time. To put it in a different way, the Bloomberg Dollar Spot Index dropped by 0.2%. It has also been noted that silver, platinum, and palladium made a bullish move during this period.

Fashion

Fashion brands linked to brutal slaughter of reptiles in Thailand (video)

The secret investigations undertaken by the legitimate non-profit organisations who released the video and images that brought these horrifying facts into the limelight reveal the savage truth of Thailand‘s reptile farms, the primary source for the world-renowned brands such as Gucci, Yves Saint Laurent, and Louis Vuitton.

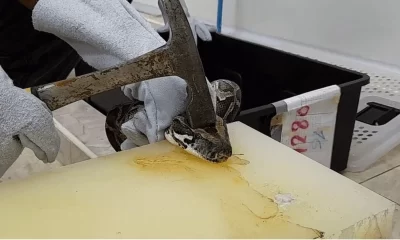

The clip shows a hammer being used to beat up snakes to death while the workers destroy forests; the moral concerns arise in the public attention due to the fashion brands reported in the footage.

In a scene that brings discomfort, the employees bash pythons’ heads with hammers repeatedly to medically paralyze them, what the experts consider a cruel method. The next action is to put metal hooks through thee heads, washed by chilled water, and confirm the stripping of the skin.

In addition to this painful experience of the Phokkathara Crocodile Farm, it can be emphasized that Kering, which includes Gucci and Yves Saint Laurent, also uses its products. Agents for the animal welfare group PTA who were working secretly managed to acquire the film that involved the capturing of the shocks of cruel and excruciating death of reptiles.

Leather Sourcing and Snake Slaughter Practices

Animal based leather was known to be sourced by an auto-leatherselling shop CCBI and Si Sactanalai, which were both owned by a father and a son, for the shoe company Caravel, which later appeared in high-end fashion brand Louis Vuitton.

The snakes undergo the severe case of the surviving, as being imprisoned into the ready cases and cardboards, often not getting farther from their own excrement. Denials and killings of the breeding seasons by owners were full of misinterpretations for weeding out the less valuable specimens.

The well known reptilian specialist Clifford Warwick, during his review of the movies, stated some concerns that the snakes may still be at the living end when they are painfully dying. Groundbreaking, snakes moved even after emphatic undertaking of semi-lethal processes.

“PETA condemns the indiscriminate infliction of pain on both snakes and crocodiles at this farm. Covering the animals in lead leads to agonizing, slow deaths of sheer pain.”

In the same time with Kering’s alleged animal welfare standards that are supposed to be in the center of its processing, the investigation by PETA about the treatment of the animals shows the opposite and highlights that the actions of Kering totally contradict its claims.

An estimated half a million snake skins are imported into Europe annually from South East Asia, showing the true severity of it. Kering and Louis Vuitton’s parent company LVMH valiantly ignored the issue and refused from commenting on the subject. The consumers also followed their narcissistic behavior and began to ask themselves where the luxury comes from.

-

News1 year ago

News1 year agoMICE industry must prioritise people management to sustain growth

-

Entertainment2 years ago

Entertainment2 years agoDark history to exotic delights: Cambodia and Thailand tourist strategy

-

Entertainment2 years ago

Entertainment2 years agoJohn Legend enjoys spring break in Phuket

-

Entertainment2 years ago

Entertainment2 years agoSiam Paragon and Bangkok Pride proudly celebrates Pride Month from May 31 – June 4, 2024

-

Entertainment2 years ago

Entertainment2 years agoPhuket’s Tourist Case court division resumes after four-year break

-

Fashion2 years ago

Fashion2 years agoFed’s rate cut sends gold soaring past US$2,200 per ounce

-

Fashion2 years ago

Fashion2 years agoFashion brands linked to brutal slaughter of reptiles in Thailand (video)

-

Entertainment2 years ago

Entertainment2 years agoTrue Corporation partners with TAT to boost Thailand tourism